Road Test: Ford Sierra RS Cosworth

When Ford invited motoring writers to drive the Sierra RS Cosworth in Spain last December, the occasion immediately passed into lore. Nobody was prepared for so much excitement and for months afterwards when two or three journalists were gathered together in one place, conversation soon got round to the subject of the Sierra.

Driving a car on a company’s selected route is one thing, using it as everyday transport and coping with rush-hour traffic can be quite another, especially since Ford’s intention is clearly stated: to build 5,000 examples for sale to the general public in order to be able to race and rally a handful. A car primarily designed for the track may have draw-backs on the road. We have yet to see the car in competition, for it is not yet homologated, but as a road car it is sensational.

Using the cast iron 1993 cc four cylinder T88 block as a base, Cosworth Engineering has created a dohc, belt driven, four valves per cylinder, turbocharged engine (with a Garrett AiResearch T3 unit) which produces 201 bhp at 6,000 rpm and 205 lb ft torque at 4,500 rpm. Over 80% of the maximum torque is available between 2,300 and 6,500 rpm, so the result is a remarkably flexible engine in almost any driving conditions.

The cylinder heads are made by Cosworth Castings at Worcester, using the patented Cosworth method, and are created alongside heads for the Mercedes-Benz 190 2.3-16. Inlet valves are 35mm in diameter while the sodium-filled exhaust valves are 31 mm. Apart from the block, auxiliary drive shaft and water pump, it shares no major components with the standard engine.

Although Ford is adamant that only 5,000 Sierra RS Cosworths will be built, it seems inconceivable that the unit will not find other applications The head can be adapted to a range of engines and, of course, it need not be used in conjunction with a turbocharger. Ford’s own press pack says it is “one of a number of new power units currently under development by Cosworth and Ford” (our italics). As it stands, over 50% more power is readily available by increasing turbo boost from the standard 8psi (0.55 bar) and inserting a different chip in the Weber Marelli engine management system. Cosworth expects to see up to 375 bhp from competition versions.

The power is transmitted via a five-speed Borg-Warner gearbox, than which you will find none sweeter. It’s a beautifully weighted, short-throw unit, crisp and precise. Between the gearbox and the viscous-coupling limited slip differential (ex-Granada) is a two-piece propeller shaft incorporating a double-tube rubber damper designed to reduce harshness from the engine.

Over 4,500 rpm the engine does get a little harsh but in top gear that’s potentially “lose your licence” time. It’s a very good turbo marriage but has the drawbacks of any turbo installation. Unless you keep the revs up, the engine may bog when taking off, and though turbo boost is progressive from around 2,000 rpm, there is still slight lag. As one who is not overly enthusiastic about turbo engines as a group, I found this unit the one most likely to win me over. In heavy traffic, it is docile and untemperamental, yet still quick to respond when gaps appear.

Externally, there are 92 detail alterations to the standard Sierra body but the most noticeable differences are the three door body shell the large rear side windows giving a much sharper line than the usual five door shell, wider wheel arches, a front air dam which gives “negative lift”, and a large rear wing which generates up to 45 lbs downforce.

Many people who stopped to admire the car expressed the view that the first thing they would do is to remove the rear wing. It certainly obscures rear vision, though the large door mirrors compensate, but worse, it’s indiscreet and a bit too “boy racer”. It’s there, of course for homologation purposes and in competition trim is no doubt desirable. We are told by Ford engineers, though, that substituting the XR4x4, boot spoiler would supply adequate stability for all save for extreme circumstances.

The other main external difference is the set of spoked 15×7 alloy wheels made by ATS and shod with Dunlop Sport D.40 205/50 VR15 tyres.

When you seat yourself in the car, the first reaction is one of familiarity for the interior is pure Sierra, at Ghia level of trim, with the exception of Recaro front seats, into which you feel you’ve been poured, the leather-trimmed steering wheel and the small turbo boost gauge set into the main instrument layout. The buyer receives central locking, electric windows and mirrors and a glass tilt slide sun roof. This last item is a “mandatory option”. That sounds Irish, but base (competition) models have a solid steel roof with the sun roof listed as an option, but you can only buy the road car in one level of equipment, the only area of choice being the three listed colours: black, white and Moonstone (a metallic blue).

Turn the key and the engine starts smoothly, very quiet at low revs. As you drive away, the first pleasurable sensation is the power assisted steering— it is light, progressive and full of feel. Together with the gearbox, it is the car’s greatest asset, you cannot buy better at any price, let alone the reasonable £15,950 which Ford asks for its supercar.

As you get into your stride, there are three other overwhelming sensations. The first is a sense of harmony among all the components, the second is the amount of information they feed to the driver, at any speed, and the third is a sense of “user friendliness”. It seems to say, “You want to have fun? Fine, let’s have fun together.”

A fourth sensation gradually dawns on one with increased familiarity, and that is that here is a motor car which will match anything regardless of class in real, A to B, driving conditions and yet has all the room, luggage space and practicality of any “reps’ delight” Sierra 1.6L. You can take four passengers and their luggage or you can fold down the 60/40 split rear seats. Behind the performance, and behind that indefinable frisson, there lurks the sturdy yeoman qualities defined by the marketing men, rather than the competition arm of Ford.

The first time you apply the brakes, from any speed, you are aware of something special. At the front there are 11in ventilated discs with 10.7in solid discs at the rear. They are operated by the Ford/Teves electronic ABS system and, when working perfectly, are excellent. There seemed to be a bug in the system on the test car for, at first, there was a tendancy, for the front nearside wheel to snatch under heavy braking. That cleared itself, but then even light applications caused snatching. In turn, that cleared, only to be replaced by the familiar thumping of ABS in action at pressures where ABS could not possibly be coming into play.

In turn, that too cured itself. It was no more than an annoying, and puzzling, sequence and something which has not been encountered over thousands of miles in several different cars fitted with the same system. When the brakes were applied in earnest, the car stopped.

The next thing you discover, when a stretch of open road presents itself, is the ride. On the launch in Spain, the car twitched at speed on uneven surfaces (high speed, dreadful surfaces) but damper travel has been increased since then giving a near-ideal ride, firm yet comfortable. When traffic looms, short straights which in even “hot hatches”, would be chancey suddenly become vistas of overtaking opportunity. You squeeze the throttle, fly past and come back into line again. The only constraint is the realisation that the man in whose mirrors you are may not recognise that it is possible. He wouldn’t be surprised by a Porsche or Ferrari, but a Sierra is another matter for it does not advertise its muscle, a real wolf in sheep’s clothing. You have to exercise psychological judgement as well as the loud pedal when passing.

When bends appear, you begin to re-define old cliches such as “the back end sticks like glue to the road”. Actually, the car is set up to give mild understeer but this can be converted to oversteer by booting the throttle in corners. You actually have to drive very hard to get the tail to break away but when it does. a quick flick of the highly geared (2.6 turns, lock to lock) steering and appropriate throttle adjustment brings everything back into kilter.

The suspension is, on paper, basic Sierra with MacPherson struts, coil springs, dampers, and anti-roll bar at the front, and semi-trailing arms, coil springs, dampers, and anti-roll bar at the rear, but Rod Mansfield and his team at Ford’s Special Vehicle Engineering division have adjusted and refined it beyond recognition.

One of the pleasant things about the Sierra shape is the low level of wind noise. Driving in Spain, we discovered that road, wind and engine noise only became obtrusive at over an indicated 140 mph. A comfortable cruising gait was an indicated 135 mph (one looked for a sixth gear at 130!). Ford claims a top speed of 150 mph and, computed from the rev counter, we exceeded this in Spain. A colleague managed to hit the rev limiter in fifth, which is 161 mph, but here we are talking about a one-way run.

Zero to 60 mph comes up in 6.2 seconds (about the same as a Ferrari Berlinetta Boxer) but such times are never flattering to a turbo car. It’s the intermediate stages, like 60-80 mph in 3.9 seconds in third gear, or the same increment in five seconds in fourth, or seven seconds in fifth, which are so impressive. You can drive for a week and not come across a car which will match it

Some have discovered a certain degree of instability in cross winds and, given the history of the Sierra, this seems reasonable, though during our test the air was relatively still and nothing at all affected our enjoyment — by day. At night, we weren’t so sure; the lights on dip certainly limited one’s pace to that of any ordinary car and, on full beam, cried out for additional wattage.

This car remains a Jekyll and Hyde vehicle. It’s a family car, at home in every condition. It’s also a sports car, more so than quite a number which pretend to be. It’s the sort of car in which you volunteer to go to the shops, for the sheer pleasure of driving, and find an interesting route via Inverness. Even in stop-start city traffic, you enjoy a sense of well-being and the overall economy of a shade better than 20 mpg seems remarkable given the performance and pleasure.

How good is it against the opposition? This is a problern, for one first has to define the opposition. The obvious rival is the Mercedes-Benz 190 2.3-16 which, though more competent in the handling department, loses in every other main area notably flexibility, gear change, steering, practicality and price. Besides, its right-hand-drive conversion is not good.

On our crowded roads away from the test track, this car is simply in a class of its own. For the price there is nothing else available which combines so much performance and driving appeal while being sufficiently practical to use as a family’s main vehicle—M.L

Motor Sport Test Results — Ford Sierra RS Cosworth 2.0

Maker: Ford Motor Company, Eagle Way, Warley, Brentwood, Essex CM13 3BW

Type: Three door, five seat, sporting hatchback

Engine: In line four cylinder, 1993cc (90.82×76.95), cr 8.0:1, iron block by Ford with Cosworth aluminium alloy, dohc four valves per cylinder, head. Garrett AiResearch T3 turbocharger, 201 bhp at 6,000 rpm, 204 lb-ft torque at 4,500 rpm. Weber/Marelli multi-point fuel injection/ignition.

Transmission: RWD, 5-speed Borg Warner manual gearbox, viscous coupling limited slip differential.

Suspension: Front — MacPherson struts, coil springs, twin-tube dampers, anti-roll bar. Rear — Independent, semi-trailing arms, coil springs, telescopic dampers, anti-roll bar.

Brakes: Ford/Teves electronic ABS, 11in ventilated discs front, 10.7in solid discs rear.

Steering: Variable ratio rack and pinion, hydraulically assisted.

Wheels and Tyres: Alloy 15in rims, Dunlop D.40 205/50 VR15 tyres.

Performance: 0-60mph, 6.2sec; 50-70mph, 3.7sec; 70-90mph, 4.5sec. Claimed maximum speed, 150mph.

Economy: Overall, 20mpg; estimated 25mpg (touring).

Price: £15,950.

Summary: Astonishing performance, particularly when price is taken into consideration, backed up by a high level of competence in every department, especially ride, brakes and steering. Combines “supercar” performance with workday practicality. A purchaser may consider replacing the rear aerofoil with a more discreet spoiler and fitting additional spotlights.

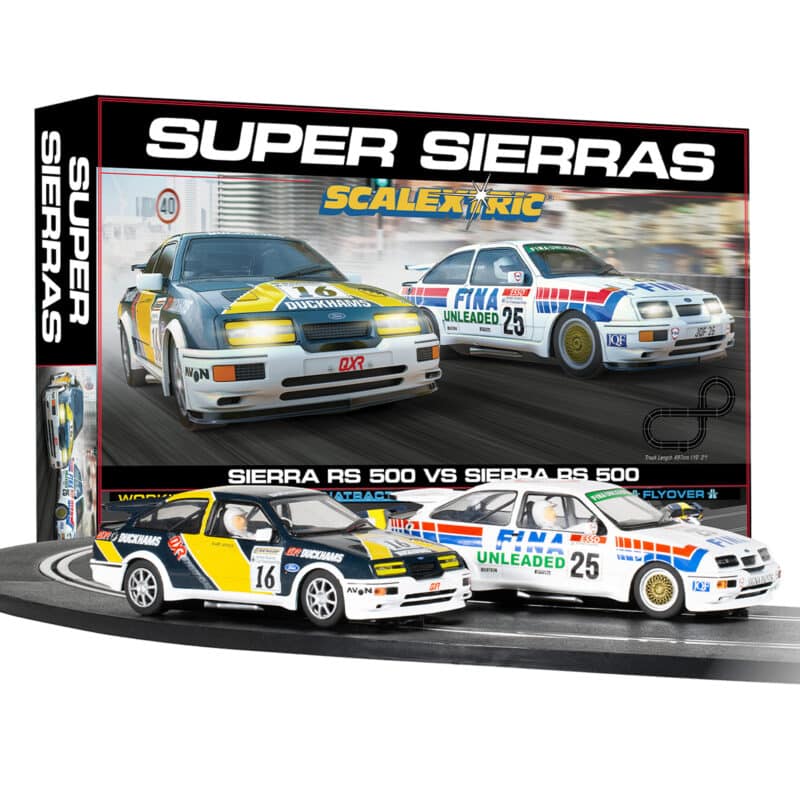

Scalextric Super Sierras Race set

£129.99

Take a nostalgic journey back to the thrilling Group A era of the 1980s with the Scalextric Super Sierra Set. Battle with two Ford Sierra RS500s — complete in old-school livery with working headlights — on a track with multiple layout options and a fly-over bridge.